We work side by side with leadership teams, as true partners.

We're a different minded investor, working fast and smart to revitalise businesses in

complex

situations and make a lasting impact.

THE DIFFERENCE IS ENDLESS

A PRIVATE EQUITY FIRM THAT INVESTS MORE.

MORE

MORE

ENERGY

Our diverse team of experts inject businesses with ambition and conviction, opening up fresh opportunities to drive growth for all.

MORE

IMPACT

We do the right thing, even when it’s hard. We enhance businesses with new capabilities and new purpose, enabling them to fulfil their true potential.

Funds raised

Investments made

Capital raised

Jobs safeguarded

DISCOVER THE ENDLESS EFFECT

OUR

INVESTMENTS

INVESTMENT

SOLUTIONS

We offer solutions that others can't, we specialise in tailored investment strategies that address the unique challenges and opportunities of each business. From revitalising established companies to nurturing family-owned enterprises, our approach is designed to unlock potential and drive significant growth.

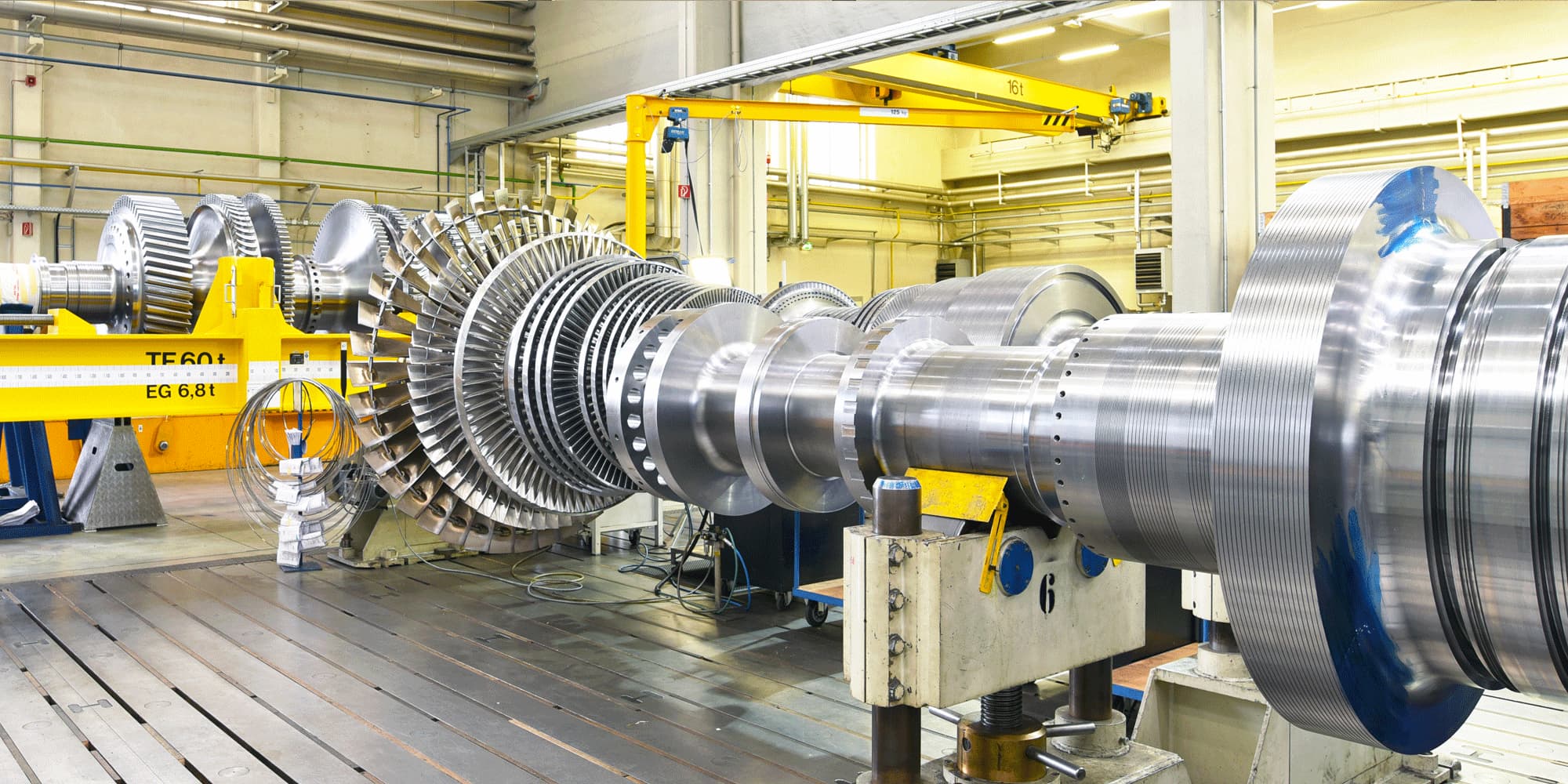

Sectors

Specialism

Our investments are focussed across a small number of sectors where we believe we are best placed to add maximum value: Food & Beverage, Industrials, Business Services and Consumer. Each sector represents a unique opportunity for innovation, growth and impact.

NEWS AND

INSIGHTS

MEET THE

TEAM

Learn more about our friendly and ambitious team, with decades of experience and knowledge.

Meet the team